Built to Build: Blog

Key Performance Indicators (KPIs) for Your Construction Business

Ever feel like construction projects are more like juggling chainsaws on a unicycle in a blindfold? You’re not alone. The chaos of schedules, budgets, and unforeseen hiccups can make even the most seasoned builder want to quit. But there’s a simple way to predict the success of your construction business: tracking your business’ Key Performance Indicators (KPIs).

WHAT ARE KEY PERFORMANCE INDICATORS (KPIs) for my construction company?

Imagine KPIs as the scorecard of your construction business. They track the critical aspects of your projects, like schedule variance, change orders, and project and operational profitability, giving you real-time feedback on how you’re doing.

But unlike your financial reports, the most effective KPIs are the ones that don’t require a deep financial analysis or letters after your name to produce and interpret.

KPIs should be simple to track and give you real-time data so that you can make informed decisions that keep your projects on track, your clients happy, and your bank account full of cash.

Now, before you dive into the deep-end of the KPI pool and start drowning in a sea of acronyms and data that require complex databases and spreadsheet formulas to understand, let’s first dip our toes in the kiddie pool with the 5 simple KPIs every contractor can track and produce without the help of a CPA or CFO or spreadsheet nerd.

We’ll call the Simple Key Performance Indicators SPIs for the purposes of this article and show you how they relate to the more advanced “standard” KPIs you’ll eventually need to track.

KEEP IT SIMPLE. GET FANCY LATER…IF NECESSARY

5 Simple Performance Indicators (SPIs) for your construction business:

- Real Cash Profit (RCP) – the actual amount of cash you have in a bank account called PROFIT.

- Average Weekly Billing (AWB) – the total amount of money you’ve billed for this week, or the total value of the work you’ve put in place this week compared to the year-to-date average your business requires to hit your budgeted revenue goal.

- Closing Rate (CR) – the ratio of the number of Projects Awarded versus the number of Leads acquired.

- Revenue Per Employee (RPE) – the total amount of revenue produced during a giving period of time divided by the total number of employees (usually measured quarterly and annually).

- Gross Profit per Project (GP/P) – the total amount of revenue received (price) for a single project less the Cost of Goods Sold (COGS) to produce the project, expressed as a percentage of the total price.

Real Cash Profit (RCP)

The way to create RCP is to open another account at your bank and call it PROFIT. Every time you receive revenue, transfer a small percentage of that revenue amount into your PROFIT account, and don’t touch it.

The money in that PROFIT account will be there at the end of the quarter and the end of the year.

Set up your PROFIT account with *Relay Financial.

You won’t need to ask your CPA or a financial expert how much profit you have, because you’ll see the actual amount sitting in your bank account.

My book, Profit First for Contractors, details how this cash management system works to make your construction business permanently profitable.

Want to take a deeper-dive into how the math of your construction business works?

Download this free resource: More Profit Less Loss: A Contractor’s Guide To How Your Profit & Loss Statement Works

*Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

Average Weekly Billing (AWB)

Let’s say that your revenue goal for this year is $1,000,000.

You’ll have to receive or produce, on average, $19,230 every week for 52 weeks.

Some weeks you’ll hit your weekly target. Some weeks you’ll exceed it, and many weeks you won’t.

That’s why tracking your weekly average is the key to spotting the trends in your construction business weeks, or even months before they “pop up.”

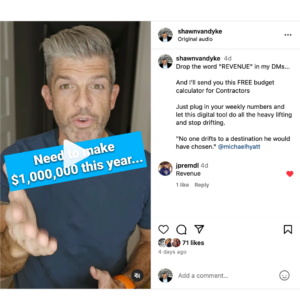

Watch this video I posted on my instagram to get a free digital template for this SPI:

Closing Rate (CR)

How many projects does your business need to produce each year in order to breakeven, and how many more projects do you need to complete so that your profitable?

That’s what the Closing Rate (CR) metric is going to tell you.

Closing Rate = # of Projects Awarded / Total # of Leads x 100%

And don’t get stoked about a high Closing Rate. A high CR usually means you’re not charging enough for your projects. Doing more jobs with small margins does not lead to profitable growth.

A good rule of thumb is about a 30% to 40% Closing Rate.

All you have to do is track the number of Leads you get each month and the number of projects you get.

Use the Closing Rate to reverse engineer your production schedule, marketing budget, and how many “Nos” you should be getting to maintain or exceed your revenue goals.

Revenue Per Employee (RPE)

Most business owners know two things about their businesses:

- In general, how much revenue they produced last year

- The number of employees they have.

This SPI gives you a high level view of your overall production metrics.

If you have 5 employees working full-time, and you produced $1,000,000 in revenue last year, then your RPE would be $200,000:

$1,000,000 / 5 Employees = $200,000 RPE

Did you make any money last year?

If not, you’re either overstaffed (expenses are too high), or you’re not charging enough for the staff you have.

RPE is super-simple to track and should be evaluated quarterly. Don’t be surprised if this fluctuates quarter to quarter. That could just be the cycle of your construction business.

But year over year, you should use the RPE to make budgeting, hiring, and spending decisions that add to your bottom line.

Gross Profit per Project (GP/P)

This SPI is the one almost no contractors track, but it’s the most important of them all.

It’s job costing.

How can you predict the profits of you construction business if you don’t track the way in which you make money – producing projects?

You can’t.

If you’re not job costing, then you’re just guessing.

Guessing is not a good strategy for profitable growth.

Track the Cost of Goods Sold for every project in a ledger so that you can see where you’re making money and where you’re not.

If you can see that 4 out of 5 projects are performing well from a GP/P perspective, then your accounting system should show the same. If not, then you know the problem isn’t production, it must be your expenses.

If you’re not hitting your GP/P on projects, then the problem is most likely your estimating. You’re not performing your projects in the same way you’re estimating them.

Whatever the solution may be for your construction business (estimating or production), tracking GP/P will show you what’s working.not working in real-time.

You won’t have to wait till the end of the year to find out you’re not making money.

Now don’t get me wrong, this does take a fully developed estimating to tracking to accounting system in place, but it’s not complicated. It’s simple.

It just takes the discipline to put each piece in place, one piece at a time, and then track every transaction each week.

Yeah, that’s right. Track your GP/P each week in your project ledgers.

WHY USE SIMPLE PERFORMANCE INDICATORS (SPIs)

Simple Performance Indicators (SPIs) aren’t meant to show you every detail of your business operations. That’s what the more traditional KPIs are for.

Traditional KPIs are like x-rays.

SPIs are more like a series of selfies – a quick snapshot of your progress right now.

By taking these 5 snapshots, without spending a lot of time digging deep in your business data, you can identify company-wide strengths and weaknesses, compare yourself to industry standards, and even predict future performance.

SPIs are like having a magic mirror that shows you the true reflection of your business, warts and all.

So, how do you get started with these SPIs?

Don’t worry, you don’t need a data science degree.

There are plenty of easy-to-use software and spreadsheet templates out there to help you track your KPIs like a pro, or…

Join our System Builders™ community for free and we’ll show you how to use each of these SPIs.

By embracing Simple Key Performance Indicators, you’re not just tracking numbers, you’re taking control of your future. You’re saying goodbye to the blindfold juggling act and hello to a world of informed decisions, optimized workflows, and happy clients (and a much happier bank account).

So, what are you waiting for?

Set up your free System Builders™ profile today and get to work.