Built to Build: Blog

Two Economic Factors Affecting Your Construction Business

The science part is knowing the numbers of your business, and the art is selling the value of your work to your customers.

In this article on FineHomeBuilding.com, I discuss two economic factors – one art, one science – to consider when pricing your construction projects.

COST-BASED PRICING

Construction is a cost-based business. You have to know all your costs, both direct and indirect, and apply a markup that not only covers your expenses (overhead) but also leaves you with a sustainable profit.

But knowing all your costs and applying an appropriate markup will not alleviate the pressure on your business caused by inflation.

THE SCIENCE – THE COST of INFLATION

Inflation is:

a general increase in prices and fall in the purchasing value of money.

If you don’t account for inflation in your pricing strategy, then you’ll be getting less for the amount of money you spend over time.

This ‘cost increase’ not only applies to the products and materials you purchase and sell to your clients, but also the cost of the labor for your employees.

According to the Bureau of Labor Statistics, the inflation rate for 2016 was 1.3%*.

*Rates of inflation are calculated using the current Consumer Price Index published monthly by the Bureau of Labor Statistics (see the Historical Inflation Rates: 1914-2017 published here.)

There are two ways you can calculate the effect of inflation on your construction business.

Effect of Inflation #1:

If you spent $100 on a product or service in 2015, that same product or service will cost you $101.30 in 2016 (an increase cost of 1.3%).

COST x INFLATION RATE = $100 x 1.013 = $101.30

Effect of Inflation #2:

If you allocated $100 for a product or service in 2015, you would only be able to purchase 98.7% of the product or service in 2016 (a decrease of the purchasing power of money by 1.3%)

HOW INFLATION AFFECTS YOUR CONSTRUCTION BUSINESS

According to Dr. Matt Harris, Assistant Professor of Economics – University of Tennessee:

“Most economists contend that slow, steady inflation is good for the economy. They key word being slow, meaning that prices are relatively stable. However, rapid inflation and deflation are generally considered destabilizing to economies.”

Although inflation can be slow over time (which is good according to Dr. Harris), if you do not account for the rate of inflation in your pricing strategy, then this can be bad for your construction business.

The decrease in profits, cash flow, or spending power might not seem like that big of a deal in any given year, but it adds up over time.

If you are like many construction professionals, you find it difficult to raise your prices on a regular basis. You might fear that you will lose existing customers with a price increase, or that you will have trouble acquiring new customers with higher prices.

But inflation is happening whether you like it or not. If you don’t account for it year after year, you won’t survive.

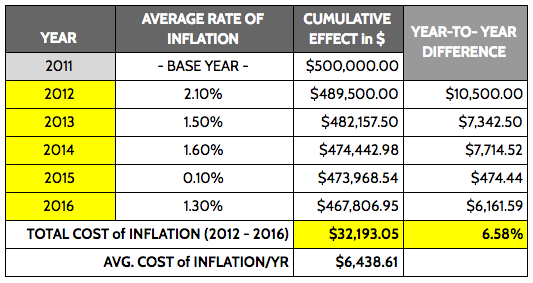

Here’s an example of the real cost of inflation over the last 5 years (2012 to 2016).

According the table above, a business that had a Total Revenue of $500,000 in 2011, would have an equivalent Total Revenue of $467,806.95 in 2011 dollars by the end of 2016.

That’s a decrease of $32,193.05 in purchasing power (or 6.58%).

Simply put:

If you don’t adjust your prices for inflation over time, you will have less money to operate your business for both the purchasing of products and services and also expenses and profit.

When was the last time you increased your labor rate?

THE ART – PRICING YOUR VALUE

Another economic factor that you should consider when developing your pricing strategy is the amount of money your ideal clients have to spend year after year.

According to the United States Census Bureau:

Median household income in the United States in 2016 was $59,039, an increase in real terms of 3.2 percent from the 2015 median income of $57,230. This is the second consecutive annual increase in median household income.

This is great news for the overall economy.

More people have more money than they did two years ago.

But the median means that 50% of the population falls below this point in the curve and 50% of the population falls above this point on the curve.

Median is the middle, not the average.

This is not a good indicator for what is actually happening within those two hemispheres of the economy.

The mean household income is a better indication of the market activity for construction business owners.

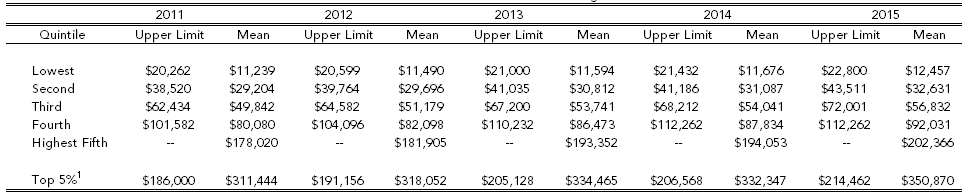

Specifically, residential construction business owners should take note of the upper 80% of Household Incomes (the 4th Quintile on the table below).

According to the Tax Policy Center, the mean (average) household income for the upper 80% went from $101,582 in 2011 to $112,262 in 2015.

These households saw a 10.5% increase in income during those 5 years.

Theoretically, this higher income bracket is the target market for many construction companies.

When you combine the fact that mean household income has risen during the last several years with the slow rate of inflation, the net effect was that this target market had more money to spend in 2015 than it did 5 years prior.

Dr. Harris explains how inflation can be a net positive for your customers:

“Most consumers are net debtors (i.e., they owe money on houses, cars) and a little bit of inflation means that those balances are less in real terms each year, meaning consumers’ balance sheets improve over time.”

When higher-income households have more money to spend they buy higher-end projects. Higher-end clients with higher-end projects value higher-end services.

If you focus on selling your value and not your price, you can increase your prices to the high-end market because they will expect a higher level of service.

This is the art of selling your value.

Increasing your technical skills as tradesperson and your customer service as a business owner will increase your reputation. If you want to develop your business and increase your profits, you need to use these two economic factors to your benefit.

Keeping your pricing on pace with inflation and offering high-value services that match your clients’ abilities to pay, will ensure you can focus on growing your construction business.

And yes, you have to grow. If you don’t, then inflation will eat away at your business, one small bite at a time.

If you want to streamline your construction business and DOUBLE your profits next month…

download my FREE book: The Paperwork Punch List