Built to Build: Blog

THE ONLY PATH TO A GOOD JOB

THE ONLY PATH TO A GOOD JOB

Most high school students want to pursue an education that leads to a successful career. In order to do that, they need confidence in choosing the right path for their postsecondary education – any education after high school such as college, trade school, or additional training.

The problem is society says there is only one path to a good job.

“Go to college and get a degree.”

Society’s only one-path mantra makes these would-be-professionals feel pressure to enroll in any university, to major in anything to secure a good job and establish financial prosperity. Dr. Kevin Fleming articulates this point in his Success in the New Economy video.

But society is wrong.

MOST JOBS OF THE FUTURE DON’T REQUIRE A COLLEGE DEGREE

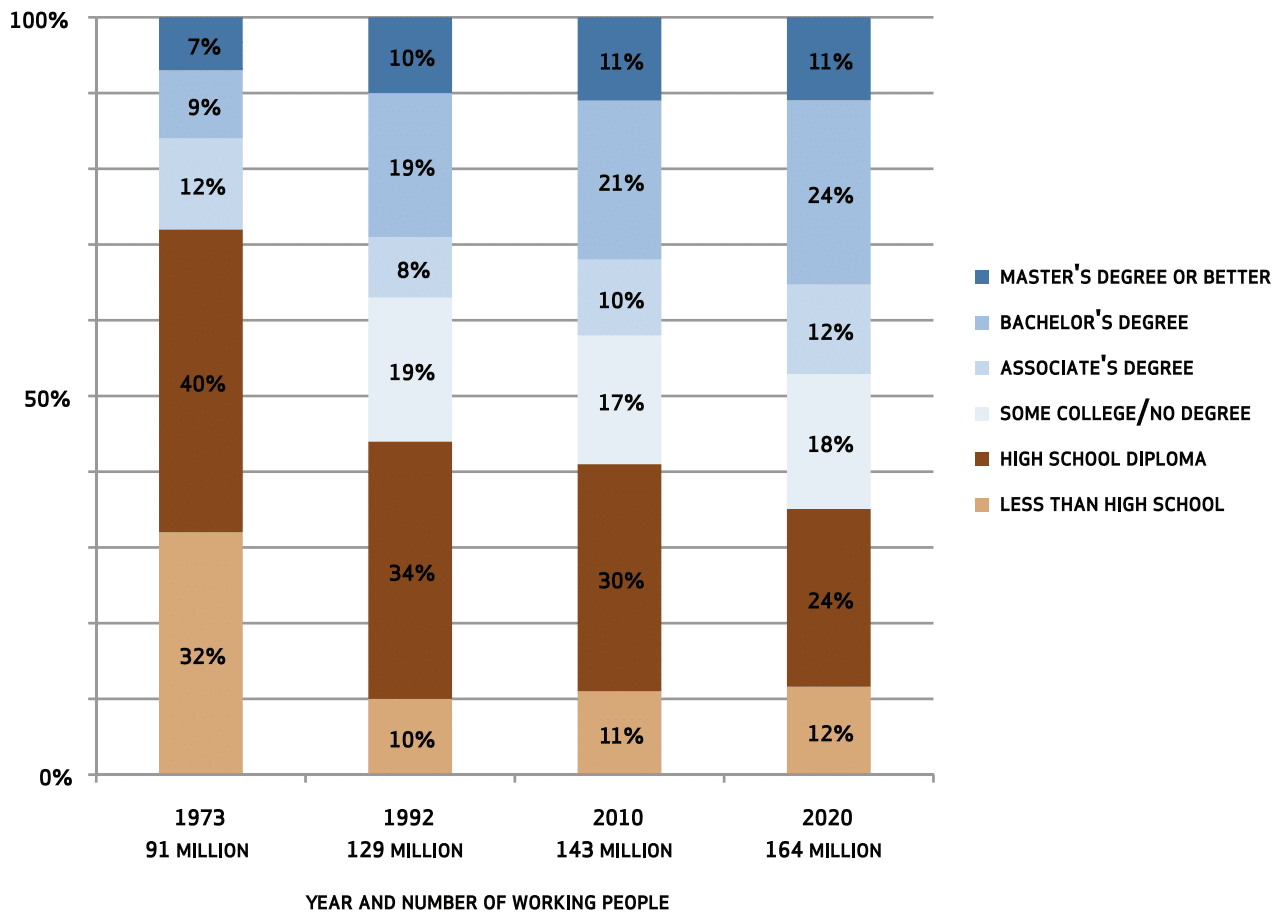

Georgetown University produced a study that reports by 2020, 65% of all jobs will require postsecondary education and training (Figure 4 from the study).

At first glance, this may seem to support the “college for all” message society preaches. But upon closer inspection, the report reveals a different story.

Sixty-five percent of all jobs by 2020 will not require a university degree.

Many of these jobs will require some postsecondary education such as an associate’s degree or some college courses, but only 35% of jobs will require a bachelor’s degree or higher.

If only 35% of all jobs require a college degree, then why does society say “a college degree is the only path to a good job?”

One reason is degree inflation.

DEGREE INFLATION PERPETUATES THE COLLEGE-FOR-ALL MANTRA

Degree inflation is a phenomenon wherein employers demand college degrees for positions that do not require college-level skills. (See this article at Forbes.com)

This article details a report by Joseph Fuller and Manjari Raman of Harvard Business School.

The report “compare[s] the percentage of workers currently working in a particular occupation who have a college degree and the percentage of job postings for that same occupation that stipulate a college degree is required.”

For example:

“…just 16% of supervisors of production workers currently hold a college degree. But 67% of job postings for these positions require bachelor’s degrees, creating a “degree gap” of 51%. Other occupations where degree inflation is particularly glaring include secretaries and administrative assistants, supervisors of blue-collar workers, and childcare workers.”

In another example, the report shows Supervisors of Construction Trades and Extraction Workers are at risk of a 44% degree inflation.

Degree inflation widens the skills gap because candidates who meet the technical qualifications don’t meet the advertised educational requirements.

Employers miss hiring the best people because the right people never apply.

Employers need another path to finding qualified candidates. They need to look at college dropouts.

COLLEGE FOR ALL. GRADUATION FOR SOME.

Many students should drop out of college. Here’s why.

Pop quiz.

How long does it take to earn a four-year degree? (I promise, this is not a trick question.)

The answer: 6 years.

Most students enrolled in a four-year degree took six years to obtain their four-year degrees.

According to the National Center for Education Statistics:

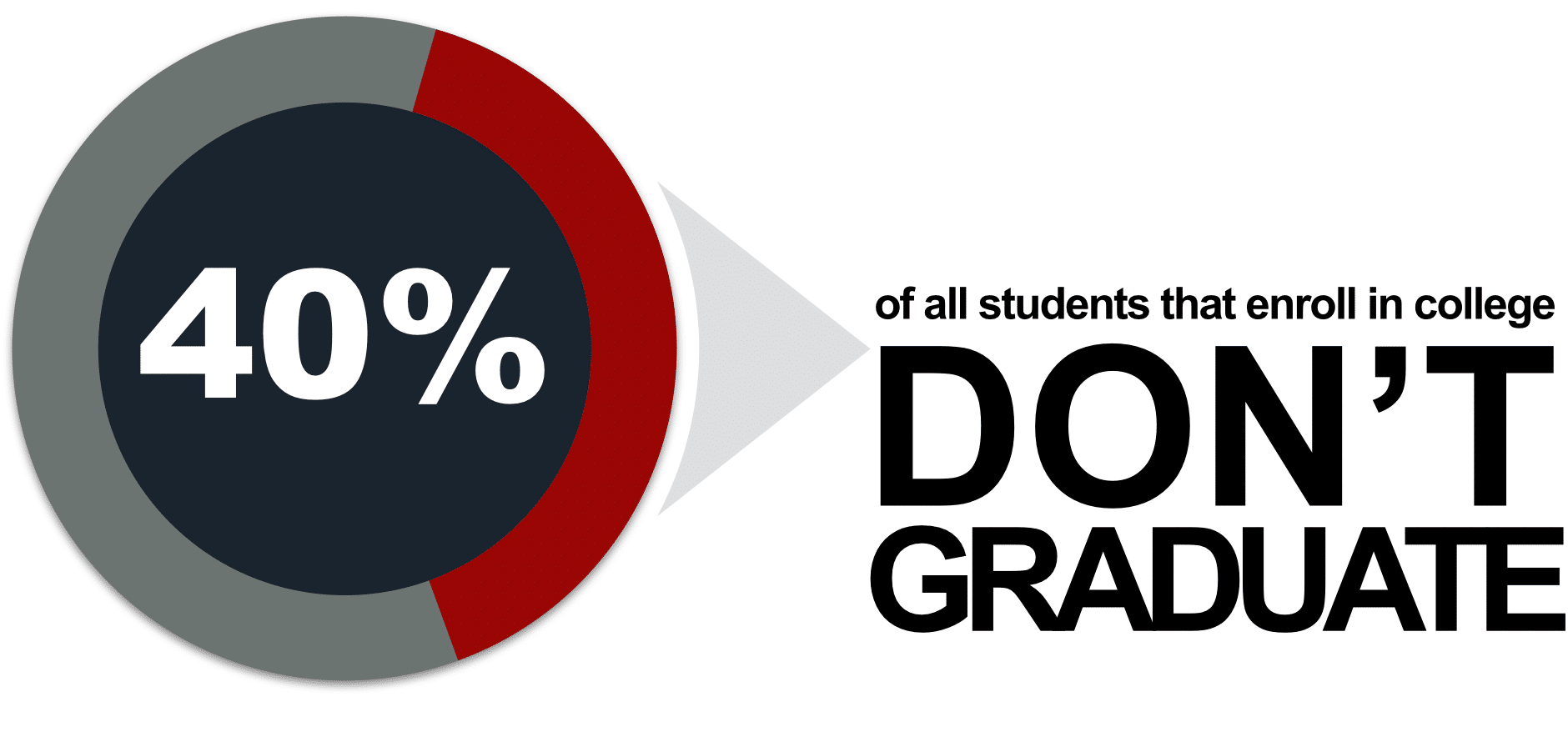

“The 6-year graduation rate for first-time, full-time undergraduate students who began seeking a bachelor’s degree at a 4-year degree-granting institution…was 60 percent.”

Not only does it take six years (on average) to complete a four-year degree, but also, only 60% of all students that enroll in college graduate with a degree.

If only 60% of all students who enroll in college graduate with a degree, then 40% of all students who enroll in college don’t graduate.

Forty percent don’t graduate even after six years.

Society is wrong.

The college path is not for everyone.

According to this statistic, almost half of college-bound students will be looking for another path within six years.

When they look for options, I hope they find the trades.

THE VALUE OF EDUCATION – A TALE OF TWO STUDENTS

Studies by Georgetown University and the Pew Research Center show a gap between lifetime earnings and yearly income between college graduates and high-school-only graduates.

In other words:

“By choosing not to go to college, you are essentially forfeiting $17,500 per year and $1 million over your lifetime.”

That sounds like a lot of money, but let’s put it in perspective.

These studies compare college graduates to high school graduates. They don’t compare college graduates to high school graduates who also have a postsecondary education.

When you consider high school graduates with an associate’s degree or additional professional training, then the income gap is much smaller.

These reports are not wrong. They are incomplete.

High-school-only graduates fare much worse than they did forty years ago, but high school graduates with post-secondary educations are the focus in this analysis. They are doing much better.

Let’s look at a tale of two students.

One student we’ll call the College Grad and the other we’ll call the Trade School Grad.

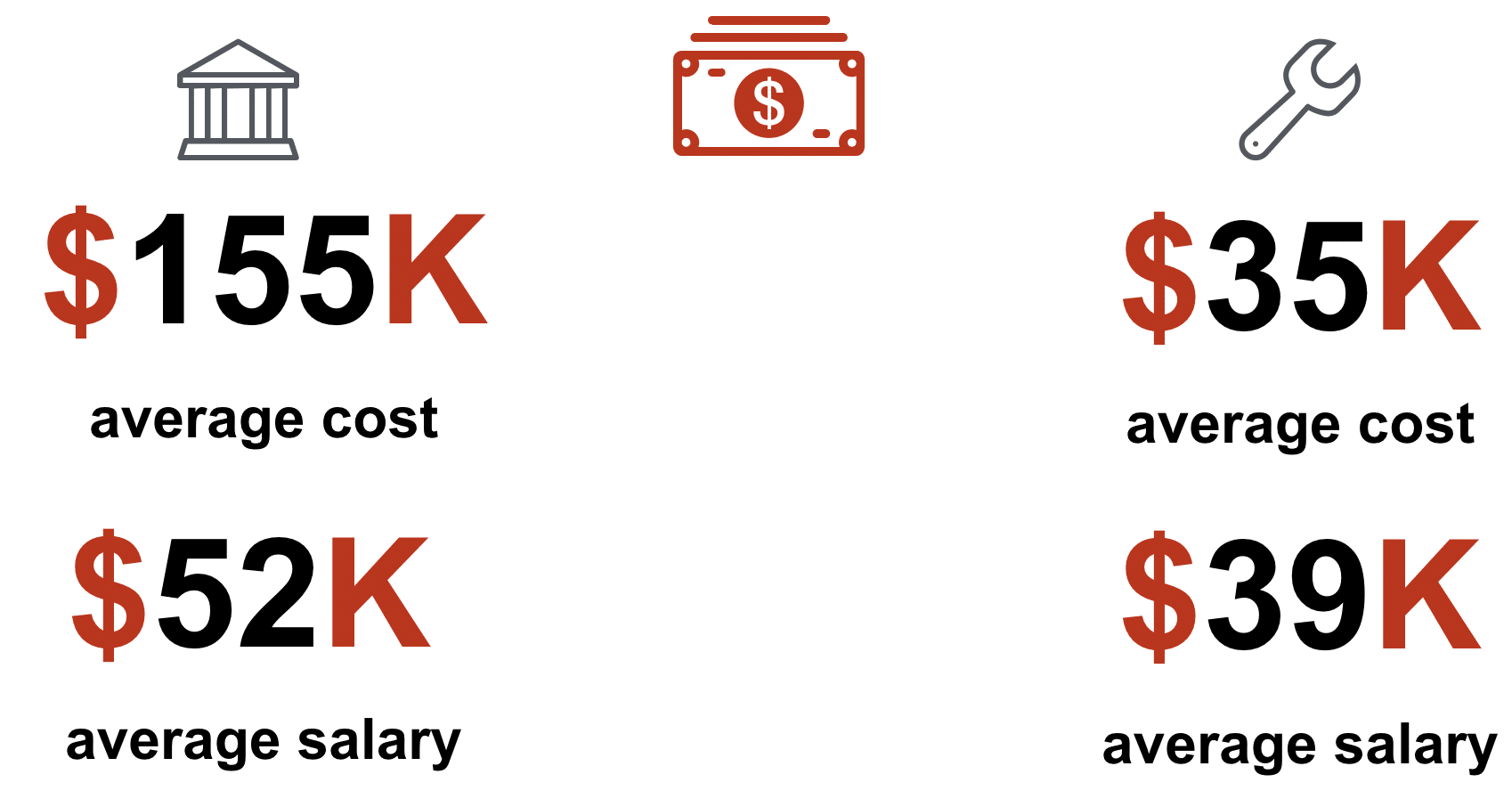

The average cost of a four-year degree (which takes 6 years to earn) is $155,000.

The average cost of an associate’s degree (assuming a 2-year program) is $35,000.

The average salary for our College Grad is $52,000.

The average salary for our Trade School Grad is $39,000.

That’s an average of $13,000 more for the College Grad.

But let’s not stop there.

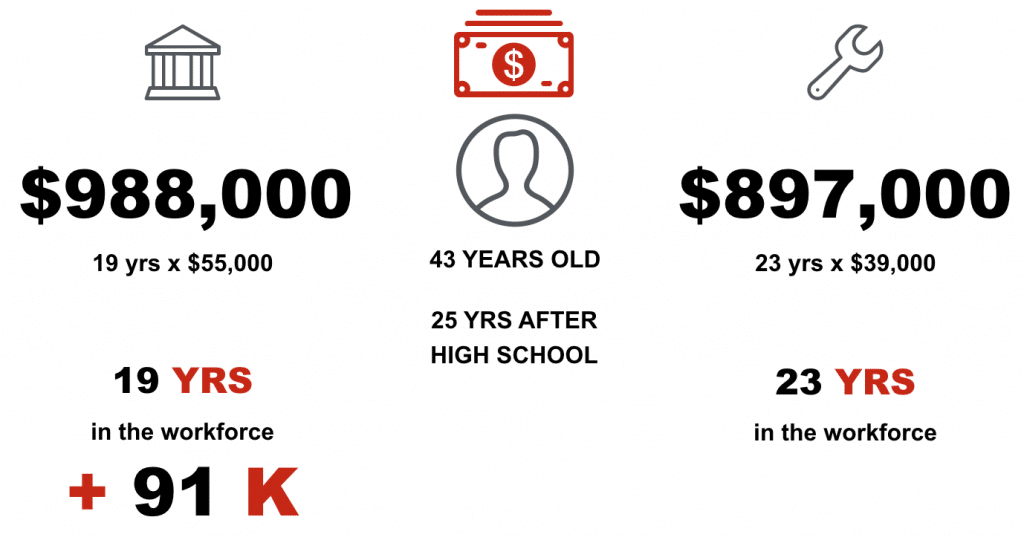

Let’s look into the future – 25 years after these two students have graduated from high school.

If we assume the College Grad graduates high school at age 18 and it takes 6 years to obtain a degree, then the College Grad will have 19 years in the workforce by age 43.

43 years old – 18 years old at high school graduation – 6 years of college = 19 years in the workforce

If we assume the Trade School Grad graduates high school at age 18 and it takes 2 years to complete an associate’s degree, then the Trade School Grad will have 23 years in the workforce by age 43.

43 years old – 18 years old at high school graduation – 2 years of trade school = 23 years in the workforce

If the College Grad earns $52,000 per year for 19 years, then the College Grad’s lifetime earnings at age 43 will be $988,000.

If the Trade School Grad earns $39,000 per year for 23 years, then the Trade School Grad’s lifetime earnings at age 43 will be $897,000.

That’s a difference of $91,000 in lifetime earnings in favor of the College Grad 25 years after high school graduation.

“Ok, Shawn. What’s the point? Looks like the College Grad comes out ahead.”

But wait. That’s not the entire picture.

We need to consider the risk involved in these two paths.

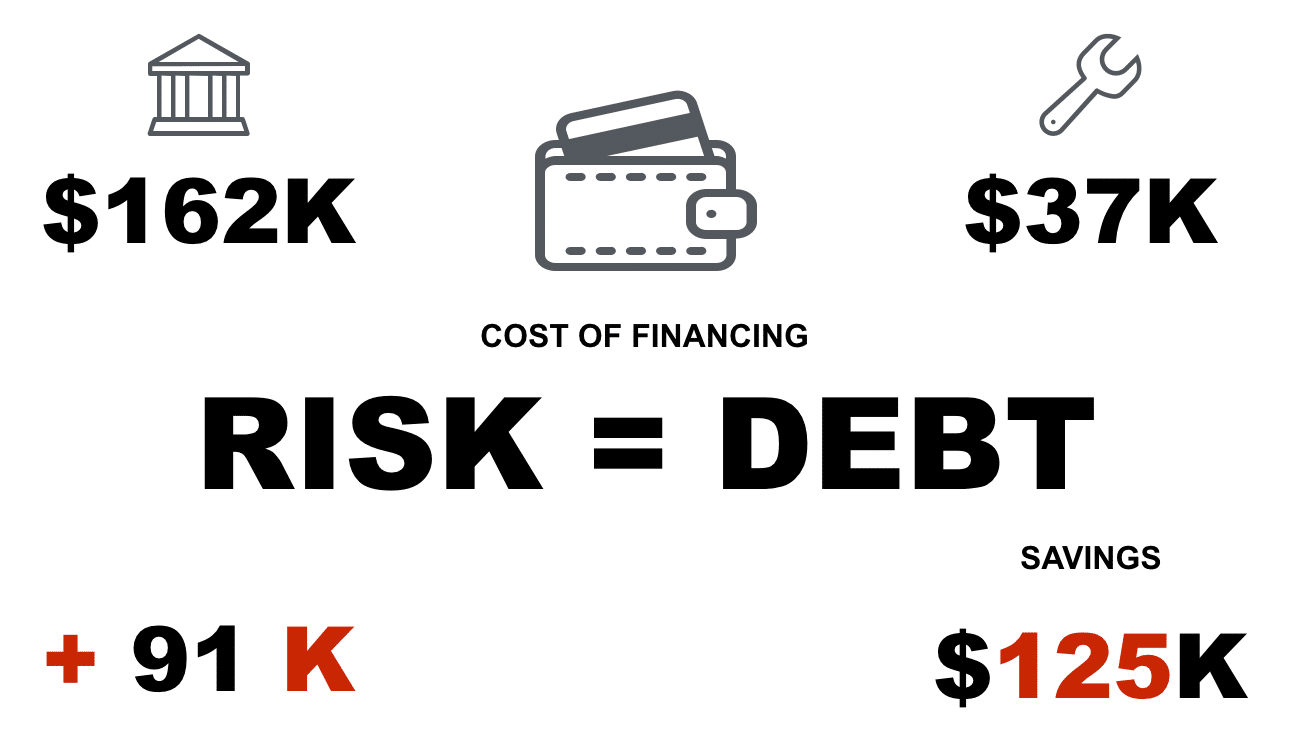

The risk for many students comes in the form of debt.

According to CNNMoney.com, students finance 20% of their postsecondary education costs.

If College Grads finance 20% of the cost of their educations at 4% over 10 years, then the total cost for a College Grad is $162,000.

If Trade School Grads finance 20% of the cost of their education at 4% over 10 years, then the total cost for a Trade School Grad is $37,000.

The Trade School Grad saves an estimated $125,000 compared to the cost of the College Grad.

When we compare this savings to the difference in lifetime earnings for both Grads, the Trade School Grad comes out ahead by $34,000.

I am not advocating skipping college. Go to college if that’s what you want to do. I am not saying that you shouldn’t finance your postsecondary education. That’s up to you.

I am saying that the message is outdated, according to the numbers.

THE OTHER PATH

Earning a college degree is not a waste of time and money for most students, but it could be for about 40% of students.

Society is wrong.

Job security and financial prosperity come through a lifetime of learning and self-improvement.

The only path to success no longer meanders through a college campus.

Another path exists, and it’s being created by people that have skills to build things with their hands.

IMPROVE YOUR CONFIDENCE AS A CONSTRUCTION BUSINESS OWNER

Do you want to make more money, streamline your construction business, and get your life back?

If the answer is “YES,” then sign up for one of my coaching programs.

Click here and fill out the application. My team will follow up with the next steps.

GET YOUR COPY OF PROFIT FIRST FOR CONTRACTORS

Remember to go buy my book, it’s on Amazon, it’s on Audible, it’s on Kindle, it’s everywhere, Profit First for Contractors.

If you want to streamline your construction business and DOUBLE your profits next month…

download my FREE book: The Paperwork Punch List

Shawn Van Dyke is a construction industry consultant, business coach, and mentor to construction business owners. He is a Brand Ambassador for Fine Homebuilding, travels across the US as a keynote speaker, seminar presenter, and the author of two books – Profit First for Contractors and The Paperwork Punch List: 28 Days to Streamline Your Construction Business.

WANT SHAWN TO SPEAK AT YOUR EVENT OR TRAIN YOUR TEAM?